YOUNG COUPLE LOSES THEIR LAST $600 TO A FAKE INTERNET SITE WHICH COMPELS A STRANGER TO APPEAR IN THE PICTURE

Most of us live an average life where we are able to fulfill our normal needs and enjoy the simple happiness of life. A family with a decent income has the biggest setback of not being able to get over the unforeseen situations. Any illness or accident can bring a whole family on the edge of losing everything they have saved after working hard for most of their lives. Our today’s story revolves around a couple whose one attempt to get a loan approved brought them in some serious trouble. It might cost them not just their children’s future but even more.

The Donovans

Living alone comes as a completely different experience after living with parents just like moving in with partners is different from living alone. But the greatest of all is the decision of becoming a family, planning to have children. What makes it an entirely unique story? Well, moving out of parents’ place is a part of the growing process, also one can easily walk out of a relationship or marriage but with children, it’s a fact that there’s no going back once you become parents.

Nathan and Madison Donovan too lived a middle-class life until a chain of events started to take place just to make everything more and more difficult for them with every other day.

Perks Of Being Parents

A couple took the biggest step of their life when they decided to have babies, and they were well aware of the instant and constant increase in expenses and responsibilities that this step will result in. But not everyone works hard to earn. Some work cunningly and trap innocent people like this couple who wasn’t aware that a bunch of bad people will try to snatch every single penny out of their pockets and will almost bring them on the pavement.

A Happy Family

Nathan and Madison Donovan were married from a couple of years and wanted to fill the empty spaces of their lives now. The couple was going to have their first baby soon and this was making them nervous and excited all at the same time. They have been planning for it for a long time and thought they were prepared for everything but who can be?

Difficult Times

In the next couple of years, the Donovans grew from two to four. So far, they were able to manage a satisfactory lifestyle but the odds weren’t in the Donovans favor anymore. Something bad happened and the couple was left without any backup plans. Wondering how did their situation get worse?

Working Their Entire Life

Nathan and Madison were both hard workers. They started working part-time in their senior year of high school and have been working ever since. They had savings, they had jobs but life turned upside down on an unfortunate day. The couple faced the most challenging turning point of their lives in 2010 when Nathan met with a car accident.

Holding On

When Madison reached the hospital, she was informed about her husband’s serious condition. The doctors didn’t tell anything about how much time he’ll take to recover completely for over a week. And finally, when they spoke to Madison, she understood that some very critical times were standing in front of the Donovan family.

Severe Back Injury

The accident caused some serious back injuries and it was going to take a really long time for Nathan to recover completely and be able to work again. This meant Nathan was left disabled for a prolonged period. The family of four had no backup plans and Madison had to quit her job for she chose to look after her injured husband. Sadly, she couldn’t be there with him for long as she had to work or else their savings will be over and they’ll have nowhere to go.

Hopeless

Looking at the doctors’ approach, Nathan felt even more hopeless. Months passed but there was no improvement in his back injury. Nathan eventually started loosing even the slightest of hopes that he’ll be able to work and support his family ever again.

The Night Shift

No matter how tough situations get we keep moving forward and that’s how life goes on, right? Madison too was planning to work on night shifts as in that way she could be with the kids in the morning and leave for office after they fall asleep.

All The Way To Downtown

Madison joined a call center in the downtown. The bus service used to end before midnight which meant commuting to the office was a difficult thing. Madison used to wait for the bus service to start to head home. It was both time-consuming and tiring for her.

Car Might Be Useful

Madison wanted to buy a car as it’ll help her to save time and efforts. Nathan too knew that car was a necessity for them and will make life easier. But they didn’t have enough savings left to buy a car and they knew they have to look for some other options to buy a car.

Searching For Options

They weren’t looking to spend a large amount of money on a car but only what a reliable car costs. After all, nobody wants a second-hand car that might break down anywhere on the way. They were going through some really rough days and were looking for good loan options. Little did know that they’ll end up losing even the last penny left in their accounts.

Desperate Time, Desperate Measure

The old saying that fits correctly with the couple’s situation is: “desperate times call for desperate measure”. Not everyone can afford a financial advisor but anyone can get free pieces of advice from the people we know. So, Nathan called his mother and they finally agreed on one way that could help them.

A Loan Online

Nowadays we are in the habit of searching for every other thing that pops up on our mind over the internet. Even the couple started googling for loan options and was expecting some good options. After going through a few websites they assumed that they have finally found a trustable organization, but did they?

Co-Signing Mom

Nathan decided to choose his mother who lived in Nova Scotia as a co-sign person. But she couldn’t make it to Moncton just to sign the loan documents and that’s when the couple decided to take help of an intermediary company. They thought it was just another company but they were wrong.

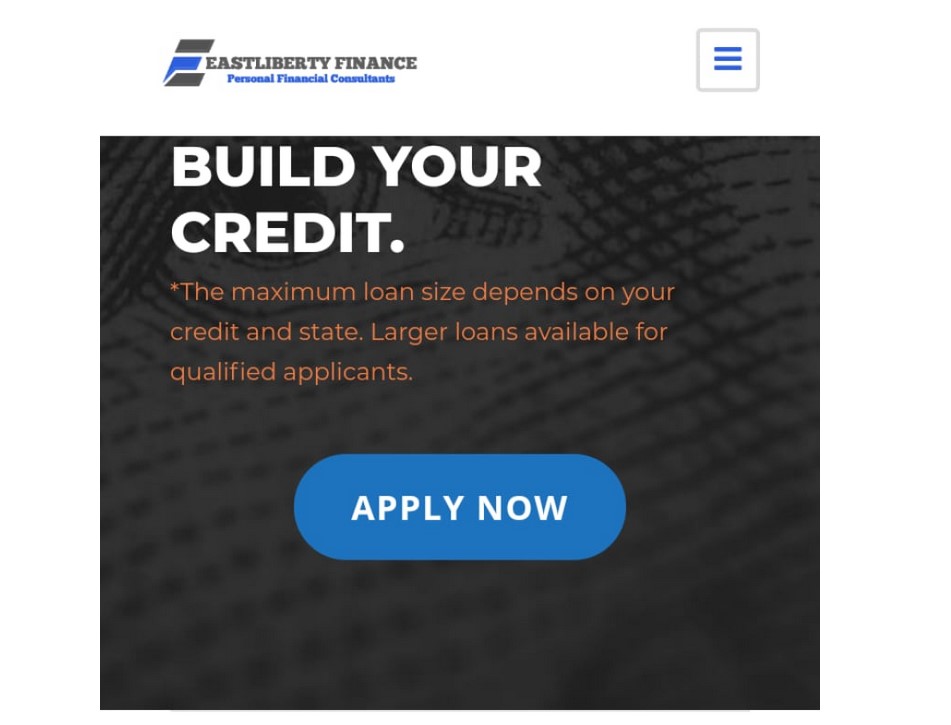

On The First Page

Nathan and Madison were convinced by a New York-based company named EastLiberty Finance Group. The link for this company popped up on the first search page. Yes, we should not completely depend on the internet but what could be the chances that a company that shows in the top results can be a fraud? Anyone would think of it to be a genuine source, correct?

Too Sketchy

“It wasn’t, like, on the 14th page and it’s getting kind of sketchy. It was on the first page,” recalled the couple who discussed among themselves before taking any further actions. They were quite certain to make sure they go through the company terms and conditions before calling their agents for advice.

High Interest

Nathan was aware that the interest rates were quite high but he was supposed to do something for his family. He did his best to check the authenticity of the company. He remembers how everything seemed to be, “very legit”.

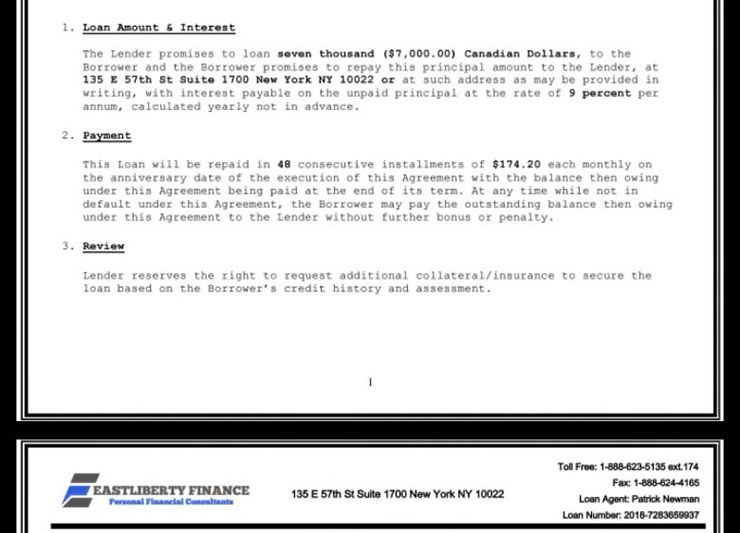

Licensing Numbers

“They had licensing numbers, their tax numbers … they sent us their loan papers, and we were able to sign them online, like digitally sign them,” recalled Nathan who thought that the company had all these facilities to make it easier for the people to get the loan.

The Wait

“Everything looked on the up and up,” explained Nathan. But soon after he enrolled his information on the company’s website, things will start to change. Minutes, after he clicked on the submit tab, he received a confirmation mail from the company.

Never Ending Time

The confirmation mail read like they’ll be receiving the loan amount within next couple of hours which max to max can get extended from four to six hours. The whole night passed and it was time for Madison to return from work but there was no money in their account yet. That’s when Nathan got the first feeling that wasn’t right.

Calling Hours…

Nathan waited for the calling hours to start to call and check what was the matter. He thought it was some technical glitch that was the reason for this delay. Not even in his nightmares, he thought that this whole thing was a trap and with every action, he was getting deeper into it.

Provide “Further Collateral”

The Donovans were told the surprising logic from the other side of the phone. According to the representative the couple was supposed to pay around $600 to the company as “further collateral” and that wasn’t all.

The Donovans were told the surprising logic from the other side of the phone. According to the representative the couple was supposed to pay around $600 to the company as “further collateral” and that wasn’t all.

Loan Insurance

As if this “$600 shock” wasn’t enough for them that the representative went on explaining how the couple also needed to apply for loan insurance. Well, it might have looked like they had an option to take a step back but it wasn’t that easy at all. Wondering how?

Make The Transfer

The Donovans were asked to transfer the money to Ontario, Canada through Western Union. Sounds fishy, right? Sadly, many people get trapped in the same manner every day. They were also given a deadline before which they were supposed to process the transfer or else their application would be denied. Nathan explained, “it would get us up out of the hole we’re in.”

A Specific Protocol

“They said it needed to be sent to Ontario to be able to transfer the money to the United States because the company was based out of New York,” recalled Nathan in an interview. It was Nathan’s first time that he applied for a loan and thought that he wasn’t aware of the overall procedure may be.

It’s A Nightmare!

Right after he sent the money to the company, Nathan called his mom and immediately realized that it was all a scam. He tried calling them, emailing them but no replies. To his surprise the website link wasn’t working anymore also the number seemed to be out of the service area. The signs weren’t good at all and it felt like this was all part of a nightmare.

Where was his money? Will he even get the loan? How would he survive if this was all a scam?

Calling The Police

With nowhere else to go, Nathan finally called the Better Business Bureau, RCMP for help. He even tried to get in touch with the fraud department of the Western Union. There were no hopes that there was any way to get his money back. All he wished, for now, was justice so that in future no one else get trapped. Little did Nathan know that he will be receiving help from a stranger…

An Investigation Was Opened

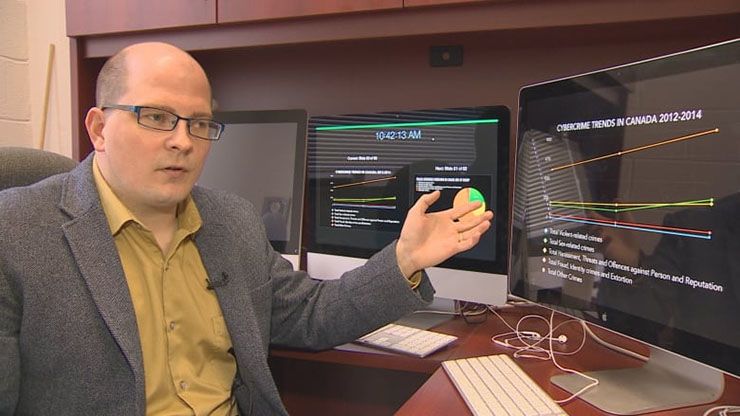

RCMP Cpl. Laurent Lemieux from New Brunswick started the investigation. It’s hard to keep a track of such websites especially when funds are already transferred to a foreign country. These scammers got their way out of it in a completely unbelievable way.

The Middleman, Also A Victim

Cpl. Lemieux informed that a middle man worked for the company, and transferred the money to Canada through Western Union. To everyone’s surprise, this middleman was equally unaware of this company’s fraud. “They’re just in a love relationship, and they’re being told, ‘I need help to get $4,000 over here. I’ve got a friend that’s going to wire it to you, can you forward.’” one representative informed.

Better Business Bureau

Nathan was clueless about the fact being that Canada doesn’t validate any advance fees, in short, it is illegal. Peter Moorhouse, the CEO, and president of the Better Business Bureau, Atlantic Canada told, “the fact that that was the structure of this arrangement, that’s what distinguishes it as a scam.”

Evil People

Moorhouse also added, “I think you have to be a special sort of evil to target people who can’t really afford to be scammed in the first place.” When the media reporters had a conversation with the CEO of Beauceron Security, a certified cybersecurity expert, David Shipley. He said and did change the end of this story.

A Terrible Situation

David Shipley said, “I almost walked out of Sobeys the other day with two loaves of bread, and I turned around and went back.” He was trying to explain how people who are facing hard times in their life should be helped by those who are fortunate enough.

Heartbroken For His Family

“I can’t walk away with two loaves of bread — you know what I mean? But other people can just take everything you have,” he added further in order to explain to the people the urgency of the situation. When Nathan’s story reached to a couple who was about to sell their car, they did something incredible.

A Gift

Denis LeBlanc of Dieppe got to know about Nathan and thought about giving his 2007 Volkswagen Jetta that he kept up for $3,700 sale. He talked to his wife and decided that they can surely help the family in need.

“Everything Is Going Awesome!”

“Everything is going awesome. The car is great. Madison is working full time, and we are no longer on assistance, which was our goal. We have a renewed sense of hope not only in our financial future but in our fellow man,” explained Nathan.

“Everything is going awesome. The car is great. Madison is working full time, and we are no longer on assistance, which was our goal. We have a renewed sense of hope not only in our financial future but in our fellow man,” explained Nathan.

No comments: